File under 2025

The year is almost over – I hope it was a good one for you, guys! For a lot of people in the community, it turned out to be quite difficult. Not so much due to the grind (which comes with the job), but because of the external factors affecting the way that we work and live.

On the political front, it's mostly the blind leading the blond; a parade of people who used to be seen as being reasonable punching through the bottom to explore the new depths of moral shallowness. With the exception of China, every major region is sitting on their horse facing the tail. And this, unfortunately, directly affects the games industry, as our exposure is global – whether it's about regulation or talent; both our creators and our players are all over the place.

Here's a few notes on 2025, and a few things in store for 2026 (the new season of Legal Challenge is on; Summit XI in Berlin is in the works, with close to 200 attendees signed up; the pieces of the puzzle for On Tour IV in Porto are falling into place; what we cannot yet announce, though, are the name of the city for Summit On Tour V in 2027 (it starts with an "M") and the first collaboration between the Summit and More Than Just a Game – heaven forbid we even mention it):

Everything must change

If you haven't read The Leopard, one of the Italian 20th century classics, you've got a great book waiting for you (the Netflix film is not too bad either, though somewhat performative). One of the famous lines from that book is that if we want everything to remain the same, then everything must change ("se vogliamo che tutto rimanga come è, bisogna che tutto cambi").

This resonates a lot with what our community has gone through in 2025: people changed companies, sometimes transitioning between law firm and in-house roles; a few veterans set up new firms of their own (at least two more announcements forthcoming), many great associates became partners; some counsel relocated to other countries, some became enviably unemployed. Law firms and studios announced intentions to merge and separate, while continuing to expand and open new offices.

Over the last decade, I've observed this happening on a regular basis – but never at such a pace, with so many things changing at once, and everywhere. I think that our cluster – our particular group of people, which is not just "lawyers" but "lawyers passionate about the complicated industry of global nature" – enters a new cycle.

The legal talent in the community responds to the changes in the environment (or the lack thereof) by finding – or creating – the positions that better fit their personal skills and experience; sometimes this means a promotion, sometimes a change of company, and sometimes a switch of role. At the end of the day, we have the same community – just better adjusted, aligning their personalities with the projects they want to pursue.

To remain true to our values and aspirations in the current environment – with new challengers and opportunities on multiple levels – things, indeed, must change.

Tribalism be damned

2025 has become the year when you can no longer guess the country where the news is coming from, without having it spelled out.

One minister says that the international law is important, but only up to a certain point. Another minister says that just because you have a freedom, it doesn't mean you have to use it at every moment of every day. And a chancellor blames migrants for a problem with the city view. In one capital, riot squads regularly beat up protesters on camera; in another, the police is busy arresting thousands for holding paper signs. Is this Istanbul and Moscow, or Berlin and London?

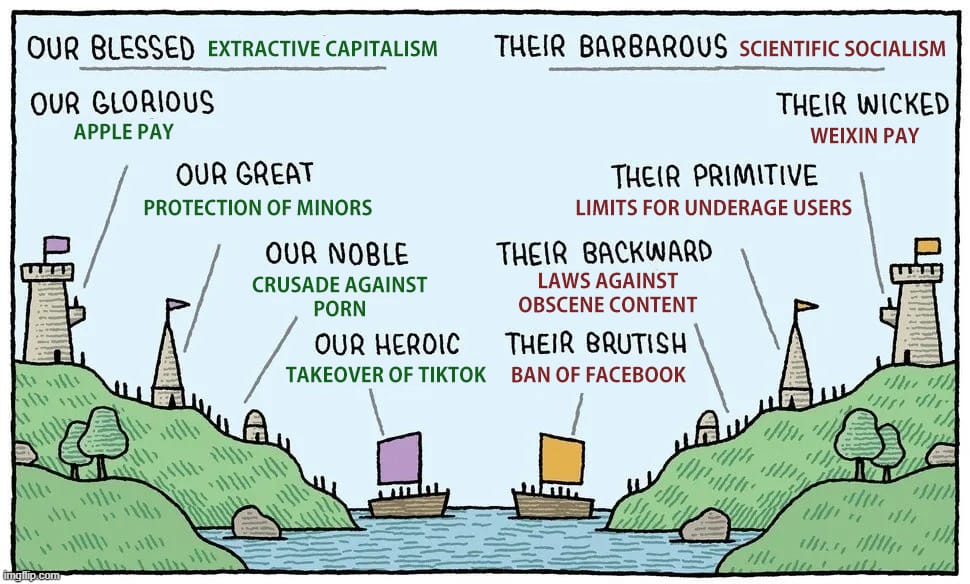

We're used to Italy's Berlusconi saying stupid things on TV. We're less used to Germany's Merz saying stupid things on TV – but here we are now, in the "ask your daughters" territory, discovering that the difference between a lot of governments is not in their [dubious] actions, but in the presence – or lack of – false pretense to be superior to the other nations.

One country seizes a private tech company based on the perceived threat to its national security. Another country does the same to a games studio. Imagine having to look up the country names before deciding whether it's a bad thing? Man or man, we're going to miss the spirit of globalism that allowed our industry to thrive and forge its international identity, fostering partnerships that last for decades (for the record, one of these seizure cases is from the Netherlands, another is from Russia).

One could argue that a bad move is a bad move, no matter who makes it. But the growth of nationalism adds noise to this signal, tribalism be damned.

These days we can no longer rely on national regulators being reasonable by default, or pursuing the public good as their mission. Remember the Red Lines, Black Lists panel at this year's Summit? It keeps getting more relevant, with multiple jurisdictions introducing all kinds of restrictions.

In 2025, we went from the US sanctioning the UN Special Rapporteur to the US sanctioning the architect of the Digital Services Act. Speaking of sanctions...

Sanctions, sanctions everywhere

We first started to talk about sanctions in the context of the games industry back in 2022, with more sessions in 2023 and 2024. At that time, we explored the specific restrictions in place for Russia, Belarus, China and Iran, and we tried to come to grips with the mental model behind these: are we supposed to enthusiastically support these, closing user accounts and relocating servers? Or we should treat them as an arbitrary barrier, and a political tool that's often contradictory?

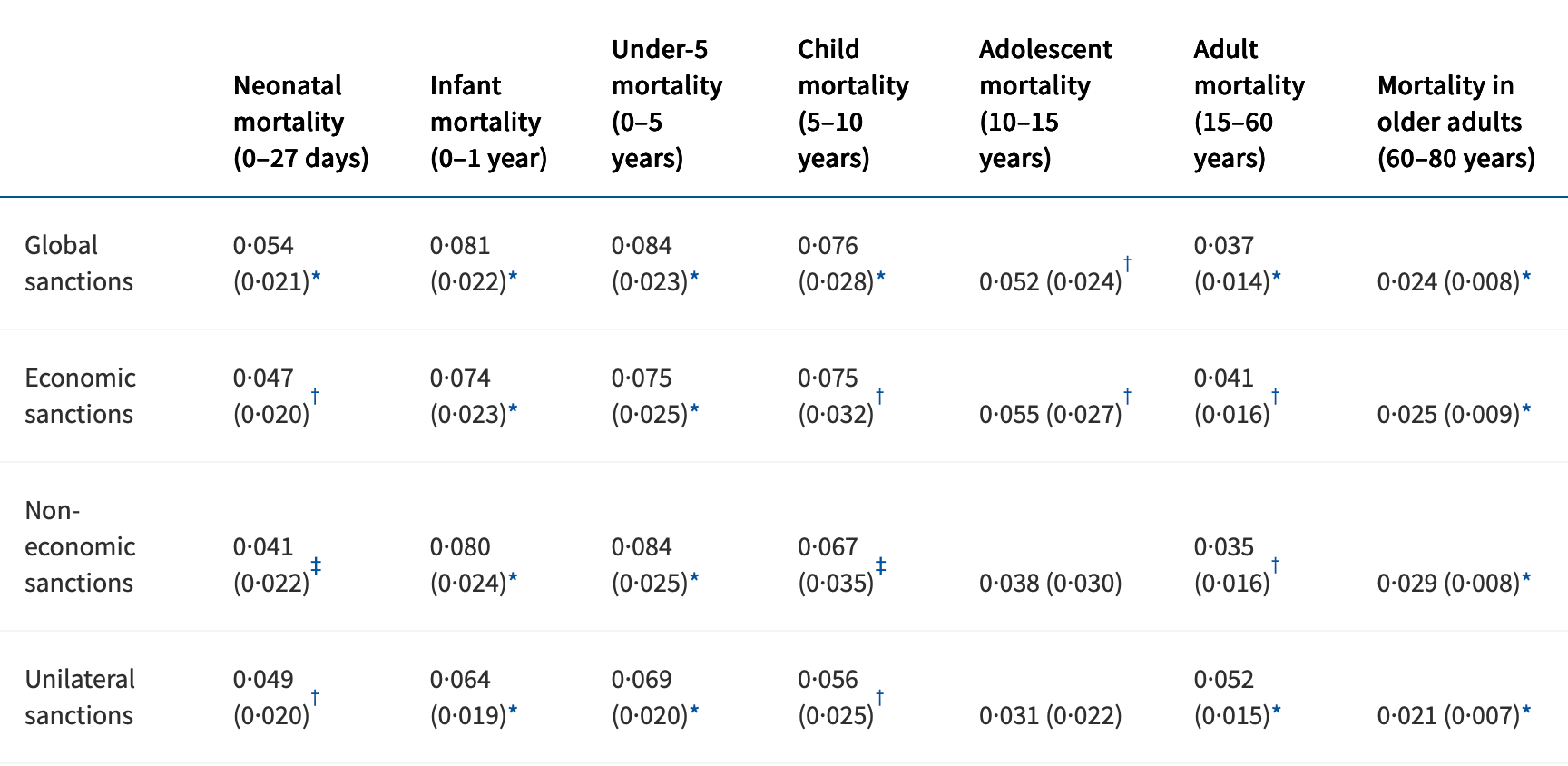

A few months ago, The Lancet – a leading medical journal – looked into the health effect of sanctions. Like with many things, medicine is a sector that's hard to cheat (wake me up when there's an AI diagnostic tool that doesn't kill patients; the stories of Anima's blunders keep coming up on a regular basis).

I wish we could open our 2022 sanctions panel with the findings of this paper:

Sanctions have substantial adverse effects on public health, with a death toll similar to that of wars. Our findings underscore the need to rethink sanctions as a foreign-policy tool, highlighting the importance of exercising restraint in their use and seriously considering efforts to reform their design.

Sanctions kill 500K+ people each year, my dear readers – mostly kids. While our product, video games, is not a life-saving medicine, the way our industry treats players and partners still has a big impact on their lives. Being unable to hire QA engineers in Minsk, fund a game that's being developed in Havana, pay contractors from Novosibirsk or translators from Xianlin, is not something that we should embrace with the unquestioning enthusiasm of the unthinking; rather, we should recognize these barriers for what they are: a crude, inefficient political tool with a lot of collateral damage and lasting side effects.

And now, some good news –

Legal Challenge IX

Last month we opened the 9th season of the Summit's moot court, Legal Challenge, which – like the games industry – welcomes talent from any country (as long as you're not into photos of people autographing bombs, that is).

This season's judge panel is chaired by Felix Hilgert, with the case by Katya Nemova that's built around the right of first offer for a sequel (but what's an 'offer', and what's a 'sequel'? more details in this post on LinkedIn).

Please give a round of applause to the fantastic set of counsels who serve on this year's panel (if you know 10 out of 15, you're a bona fide veteran!) –

As of today, the case files have been retrieved a bit over 120 times; with team applications flying the flags of 🇫🇷 France, 🇵🇱 Poland, 🇩🇪 Germany, 🇸🇪 Sweden, 🇺🇸 USA, 🇮🇳 India and 🇪🇹 Ethiopia.

We just released the clarifications for the case; competitors can register until January 19, with the first memorandum due on January 30. If you know associates or law school students who may want to try their skills – and, possibly, win a set of tickets to the Summit in Berlin – please share this link.

Mentors wanted!

This year, just like during the last season, a lot of teams who signed up to compete in the Legal Challenge added industry mentors into the mix (see, I managed to link the story with the photograph from the Summit's bar!).

We're grateful to Anna Kruszewska, Ross Dannenberg, Vikram Jeet Singh, Michael Beurskens and Xuyang Zhu for coaching the teams – thank you for sharing your experience and insights!

We are currently on the lookout for at least 3 more mentors, all of them in the North/South American timezones: if you're open to mentoring a moot court team, please let me know? They have a bit over a month to submit the memo, so the impact could be pretty big.

We also expect more applications, and more teams asking for mentors, so even if you're not in the Americas, we'd love to know if you're available!

Summit XI in Berlin

The registrations for 🇩🇪 Summit XI in Berlin (June 2-4, 2026) continue, as well as the development of the program. We plan to talk about:

* killing games (what's a game? and what's a killing?)

* dealing with leaks (internal and external)

* pushing back at compliance for the sake of player experience

* the business model of UGC (and what do you buy when you buy one)

* the joys of cross-media licensing

* class action and consumer rights in the context of games industry

* regulatory trends (first you laugh, then criticize, then imitate)

* regulatory threats ('violent tax', DFA, chat control, etc.)

As we're closing on 200 attendees, the venue hotel (KPM Hotel & Residences) is filling up. If you need a room, please talk to Alma to get the special rates (we also now have a backup partner hotel next door, as the standard rooms at KPM are now sold out).

Summit On Tour IV in Porto

This month, we made good progress with the planning for 🇵🇹 Summit On Tour IV in Porto (October 6-8, 2026) – with the first round of meetings with the local authorities, and a review of the hotels.

Good news: the hotels are amazing, and offer the best value I've seen so far (one of the partner hotels has suits with 2 floors, overlooking the Douro river; another has a smoking corner which is, actually, a smoking garden – a designated open-air space specifically for those who like to inhale unhealthy substances surrounded by the lush greens). As to the restaurants, we're in the league of Italy and Cyprus here.

We keep the registration fees for this 2026 edition at the 2024 level, and we invite you to bring your associates and younger counsels for a diverse, no-stress edition of this conference.

I wish you a few days of peace and quiet, whether it's a religious-themed holiday or a change of date on the calendar that's celebrated in your country, and I look forward to doing more things together in 2026 – from the moot court to the interviews and articles, and to the actual conferences, and their cross-country deep dives.

With the warmest of regards and the bestest of wishes,

– su hermano Sergei